Imagine taking a trip to free your mind and then an idea occurs that not only will free you but free those around you.

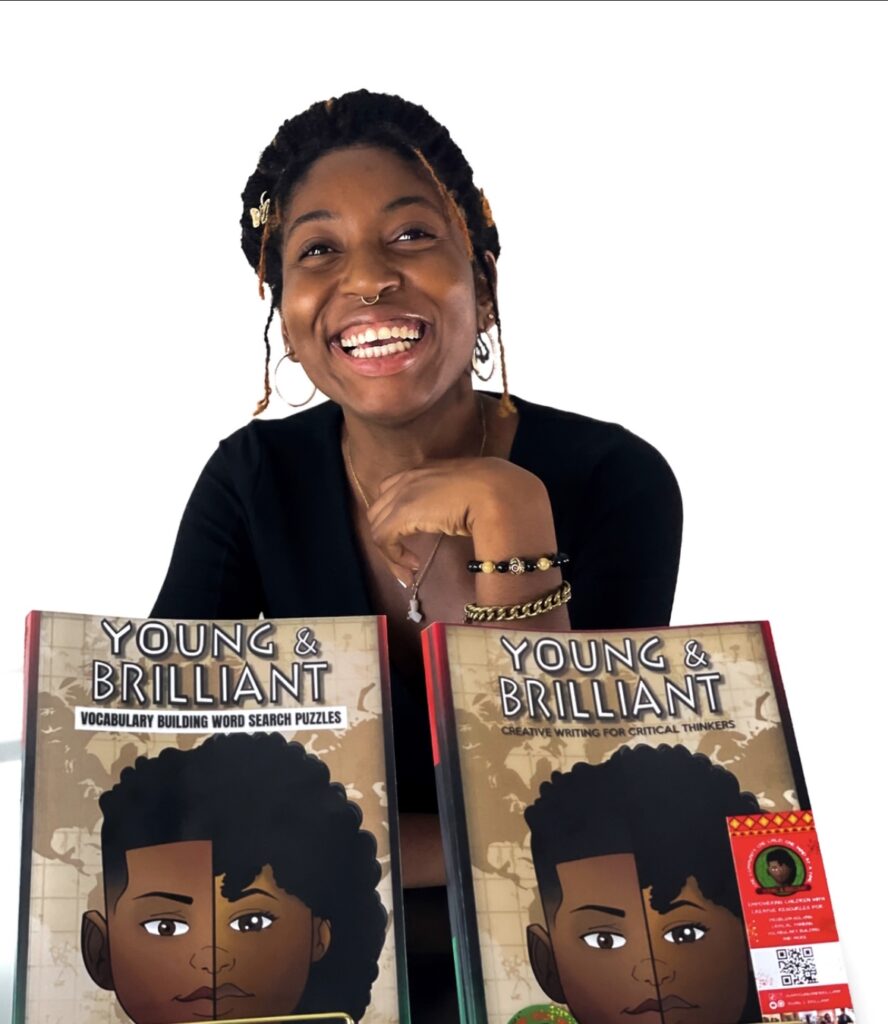

Well, that’s exactly what happened to Desiree’ Faye who is the mastermind behind a brand called, Young & Brilliant.

The idea for the brand came to life during a solo trip she took to Egypt. There she stated that she had an epiphany while overlooking the Nile River. She realized that there is a communication gap between Black employees and others in the corporate world. Desiree’ came to the conclusion that it was not a skillset issue but a foundational issue that stems from African American employees not being taught the same critical thinking frameworks as their counterparts, which greatly affects their corporate experience. This inspired her to create a foundation for our youth that focuses on teaching them the foundations of critical thinking, entrepreneurship, and financial literacy, to bridge the racial economic wealth gap and provide the missing foundation for our youth.

Take a look at our discussion with Desiree’ Faye below.

Share with us what made you create a brand that focused first on our youth when it came to dealing with financial literacy.

During a transformative solo trip to Egypt, I realized the pressing need to empower youth through critical thinking. It was an eye-opening news article that shed light on the staggering projection of 228 years required to bridge the racial wealth gap. Motivated by these revelations and my observations in the corporate world, I founded Young and Brilliant with a mission to equip and empower youth in underserved communities. Our workbooks and programs focus on three core life skills: financial literacy, critical thinking, and entrepreneurship. By providing these skills, we aim to prepare and uplift young individuals, ensuring they have the tools to overcome challenges and succeed.

What have been the success stories since the release of your workbooks?

Since the release of our workbooks, we have experienced numerous success stories that have filled us with gratitude and excitement for the future. Firstly, I had the incredible opportunity to be featured on a TV show where I was mentored by the CEO of Chegg and the CEO of My Fab Finance, who are both renowned experts in the field of financial literacy. This experience helped us reach a wider audience and expand our impact.

Additionally, we are proud to learn of the growing list of schools of schools and community organizations that are adding our books to their curriculum. We receive heartwarming emails from parents and teachers who have praised the relatability and easy-to-understand nature of our workbooks. Knowing that our materials are making a positive difference in the lives of young learners is truly rewarding.

We have also been invited to host workshops and events with esteemed youth organizations such as the YMCA, allowing us to engage directly with students and empower them with essential life skills. It is inspiring to hear students share how our workbooks have sparked their desire to start their own businesses.

One of the most gratifying aspects has been witnessing our significant growth in just a year. It is a testament to the value and impact we are making in the lives of young individuals. We’ve recently launched our puzzle subscription, adding a new dimension of interactive learning to our offerings.

Looking ahead, I am filled with gratitude and excitement as we embark on Part 2 of our roadmap. The success stories we have witnessed so far only fuel our passion to continue empowering youth and creating a brighter future for generations to come.

Our youth are the future leaders of tomorrow, what are some helpful ways that parents can show our youth how to handle financial stress?

Parents play a crucial role in equipping our youth with the skills to handle financial stress and become responsible leaders of tomorrow. Firstly, parents can start by setting a strong foundation by teaching their children about how money works. It is important to remember that financial literacy education is only mandatory in 18 states, making it even more essential for parents to take the lead in this area.

Once the foundation is set and children have a solid understanding of how money works, they will be better prepared to navigate the financial pressures they may encounter in the future. By instilling the knowledge of proper budgeting, growth strategies, saving habits, and investment principles, parents can empower their children to make informed decisions and manage financial stress effectively.

Fostering open and honest conversations about money can help families create a supportive environment for discussing financial matters. Parents can share their own experiences and lessons learned, encouraging their children to ask questions and seek guidance when needed.

It is also valuable for parents to lead by example and develop the areas they are not strong at. Understanding the generational lack of financial education in underserved communities, we developed a workbook to assist parents with this. Demonstrating responsible financial habits, such as living within means, saving for the future, and making thoughtful spending choices, can impact children’s financial behaviors.

Are you also incorporating programs to help adults as well who lack the knowledge of how to handle and communicate their feelings about their finances?

We have a program that we are finalizing and partnering with other organizations that focus on educating the family in the life-skills area. Part of this includes financial literacy and will empower parents to work with their children to make financial choices that will set future generations up for success.

The Department of Education has announced that student loan payments will resume in October. What are your thoughts on this?

Having been featured on a TV show focused on the student loan crisis and a graduate with student debt, I am surprised that we haven’t made more progress in addressing this issue. Drawing from my background in consulting and problem-solving for companies, I believe there are tangible solutions available to not only assist students burdened by student loans but also prevent future generations from acquiring excessive debt.

In an article I wrote on LinkedIn, I shared an action plan outlining how students can attend college with reduced or even no debt. I personally implemented these strategies and managed to secure funding for my freshman year. Although I faced a setback due to some missteps during my first year that didn’t allow my scholarships and grants to renew, I was fortunate enough to discover methods to tackle my bill freshman year.

To address the student loan crisis, we need to bring together the right minds and approach the issue with the same problem-solving techniques used by management consultants for major corporations. By collaborating and brainstorming solutions, we can develop a comprehensive plan that not only prevents students from a lifetime of debt but also provides relief for those already burdened by it. Many companies are already offering assistance to their employees with student loan repayment, and expanding such initiatives to more companies could be an excellent starting point.

Young and Brilliant is dedicated to providing books and resources that teach life skills and problem-solving strategies necessary to discover resolutions to issues like America’s student loan debt. It’s time to prioritize finding sustainable solutions that empower students to be innovative and enterprise builders in order to remain competitive in the developing world.

Learn more about Young and Brilliant by visiting the website: https://www.youngandbrilliant.org/