Two words – financial education.

It’s something we all wished we learned more about at an earlier age. But unfortunately, we are not taught this in high school or college. We as young adults don’t learn the importance of a budget, a credit score, or debt until we are paying our own rent. You’re fortunate if your parents taught you anything about money at all. And though it seems these basic financial concepts should be easy to understand, we have all made mistakes when it comes to financial planning and financial wealth.

I will be the first to admit it too. I remember when I was younger and working at my first job, my mother would say something to the effect of, “you’re working for Target money, but shopping in Macy’s.” At the time, I didn’t quite understand what she meant, all I knew was I had my own money and I will spend it how I like. I was so bold. I definitely learned my lesson about spending habits. And fast forward a few years later, I was fortunate enough to receive advice that has guided me in navigating my own journey to financial wealth. But not all of us are so lucky.

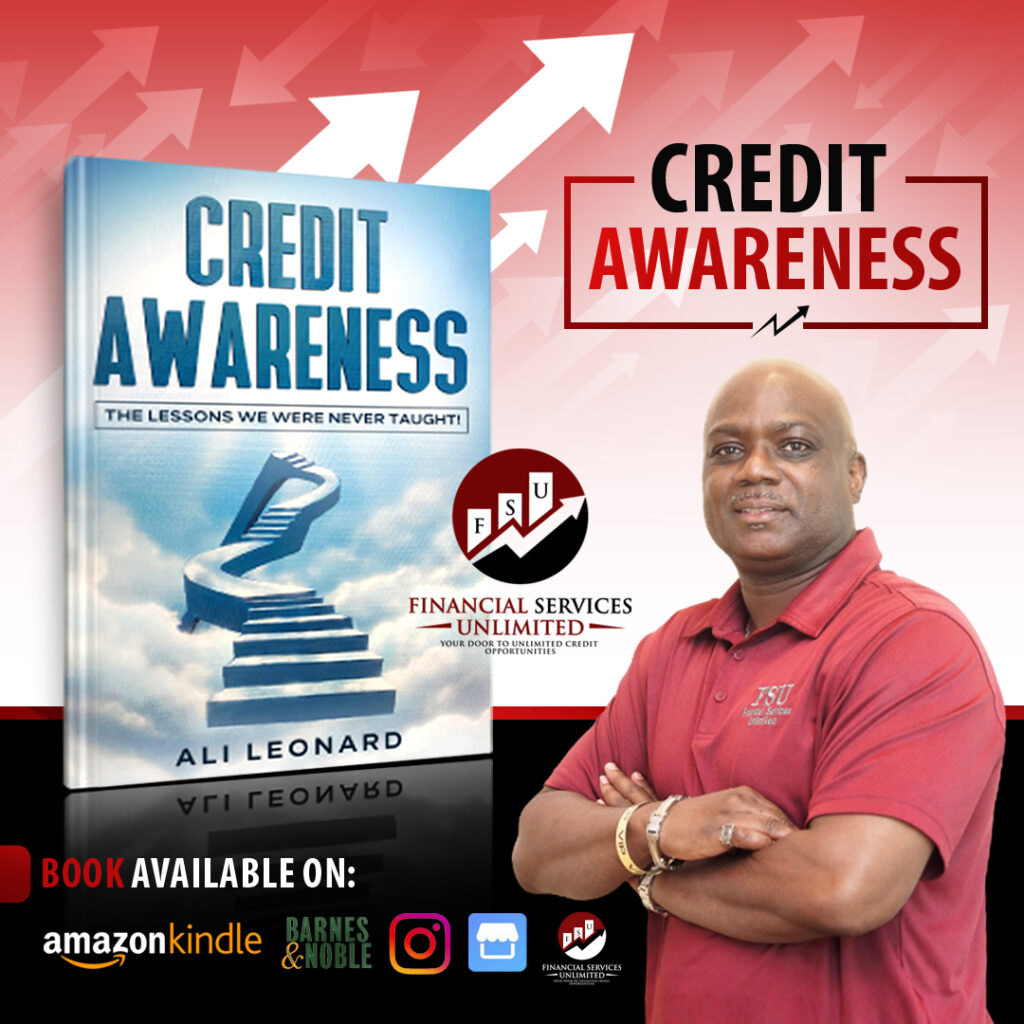

Now comes Ali Leonard, the CEO and President of Financial Services Unlimited, Inc (FSU). With an educational background in computer science and math from Tennessee State University, Leonard became a trusted leader in the credit industry as he has worked in the financial and real estate industries for over 20 years. He has worked with Credit Plus Credit System, Memphis Consumer Credit Reporting Services, Novastar (CSA) Credit Services, Data Facts Credit System, Equifax, Experian, and TransUnion. Leonard is also a Board Certified Credit Consultant, Certified Credit Repair Specialist, Certified Credit Score Consultant, FCRA Certified, and FDCPA.

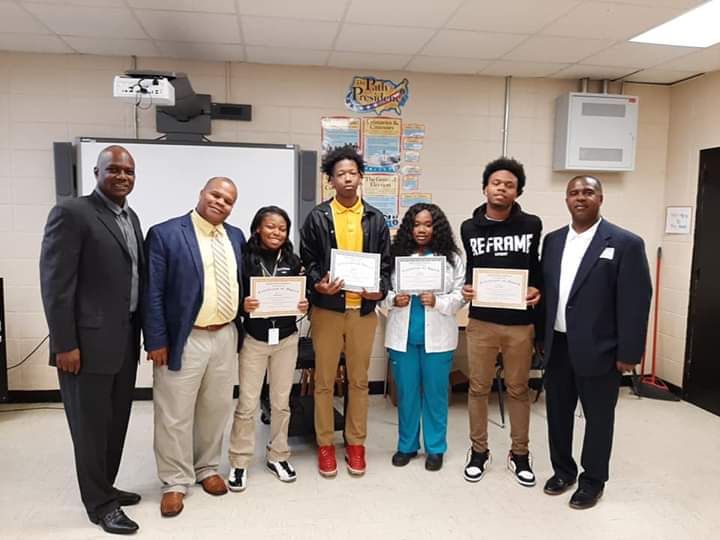

Leonard provides everyday consumers with credit consulting, credit education, and credit awareness services. He has developed a credit awareness curriculum for elementary, high school, and college students. At a national level, Leonard has conducted credit awareness seminars, for high schools, colleges, churches, and private organizations.

In a recent interview with FEMI magazine, Ali Leonard shares budgeting tips, credit repair dos and don’ts, and his inspiration for his latest book, “Credit Awareness”.

Do you feel that there is very little interest in the black community towards credit building and restoration? If yes, please explain.

“Yes, there is! One, there is a lack of trust in our communities due to SCAMS and people losing money by going to credit repair companies that don’t do what they say. Two, there is a lack of education or awareness of how credit works. Most don’t realize credit was meant to build wealth and not debt. Three, not recognizing the importance of having good credit and the options that it gives you, and finally having a lack mindset and just looking for an easy way out of a hard situation.”

What inspired your book? Where can it be purchased from?

“I have been in the credit industry for over 20 years and I have done hundreds of seminars for high schools, universities, churches, non-profit organizations, and other private organizations on credit education and credit awareness. I have been asked by my clients and others to write a book for years. We all know credit is not taught on any educational level. How can we play the game if we have never been taught the rules? I wanted to provide people with a BLUEPRINT on what to do and how to do it. Having good credit provides people with options and can create WEALTH. The book can be purchased via our website fsucredithelp.com, Amazon, Barnes, and Nobles, Instagram.”

Is there an easier way to eliminate student loan debt? What are the steps needed?

“Student loans are a BEAST within themselves. Student loan debt is in the trillion-dollar range. Most is interest. The average interest rate is 8% with terms ranging from 10-20 years. Student loans can be deleted from a person’s credit report, but you are still responsible for the financial obligations. The easier way to eliminate student loan debt is not to get it. The quickest way to pay off loan debt is to set up BI-WEEKLY payments with the lender (or the government). This means making half your payment every 14 days.”

Example: If your payment is $200 a month then you pay $100 every 14 days. More money is going toward the principal by paying this way.

How can an individual find the best program to help restore their credit when so many are offering these services? Any specific things to look out for? Any red flags for scams?

“When I started FSU back in 1999, there were very few people repairing or restoring credit back then. Now everybody is trying to do credit. If you are in the market for support for credit restoration and achieving your financial goals. I offer the following list to consider:

Testimonials: Review what people are saying about the company

History: Review the history of the company

Benefits: Explore the exact benefit that is being provided. Increasing your credit score is the idea, but how will I MAINTAIN the score? How will I build WEALTH instead of building DEBT? These are the imperative questions that you must ask yourself.

Education: If they don’t teach about the basics of the laws that govern the agencies, attorneys, and the credit system itself they are failing you. If I give you a higher credit score all I have done is given you the ability to get more STUFF and more DEBT.

“We offer a Credit Program that includes credit education, increasing credit score, budgeting, debt elimination, 12-month consulting program building positive credit just to name a few.

RED FLAGS: If they promise to remove every negative account you have. If they promise to have you at a 700 credit score in 30-60 days. If it sounds too good to be true it probably is. RENEWING CREDIT takes time!!!”

What’s the best way to build credit besides credit cards?

“Building positive credit takes time and persistence. Knowledge of the information is more important than most people realize. Ten percent of your total credit score focuses on the type of credit. You would need both revolving (credit cards) and installment accounts (car loan, personal loan, student loan) to get more points in this area. If you have little to no credit you can get a secured loan but those with good credit can get an unsecured loan or car loan to help increase their credit score.”

What budgeting tips do you have?

“Creating a “BUDGET” or some like to call it a “SPENDING PLAN”(less negative connotation) is a major piece of the puzzle. Seventy percent of Americans live paycheck to paycheck. Budgeting is a method to get you out of the financial hole you may be in. It takes commitment, dedication, and sacrifice to set up and continue with a budget. Financial literacy is the key to survival and thriving in this world today. If you want to control your spending and work toward your financial goals, you need a budget.”

STEP 1: Gather Your Financial Paperwork

Bank Statements

Investment accounts, Savings

Recent Utility Bills

W-2 and Pay Stubs

1099

Credit Card Bills

Receipts from the last three months

Mortgage, auto loan statement, or rent

STEP 2: Calculate Your Income

How much income can you expect each month? If your income is in the form of a regular paycheck, then use the net income or take-home pay amount. If you are self-employed or have outside sources of income such as child support or social security include that as well.

STEP 3: Create A List of Monthly Expenses

Mortgage or Rent

Car payments

Insurance

Groceries

Utilities

Entertainment

Personal Care

Eating Out

Childcare

Gas/Fuel

Travel

Student Loans

Savings

Everything that you pay out each month should be accounted for on this list.

STEP 4: Determine Fixed and Variable Expenses

Fixed expenses are those mandatory expenses that you pay the same amount for each month such as mortgage or rent, car payments and insurance, utilities, loans, and anything that will remain the same from month to month.

Variable expenses are the type that will change from month to month such as groceries, gas entertainment, eating out, household goods, etc.

STEP 5: Total Your Monthly Income and Expenses

If your income is higher than your expenses you are off to a good start. This extra money means you can put funds toward areas in your budget such as retirement, savings, Debt Elimination, or purchasing Life Insurance as a savings vehicle. If your expenses are more than your income that means you are overspending and need to make some changes.

STEP 6: Make Adjustments To Expenses

If you are in a situation where expenses are higher than income find areas in your variable expenses that you can cut. Look at places you can reduce your spending like eating out less, eliminate non-essential expenses like canceling a gym membership, cable, netflix, and other subscriptions, hair, nails, entertainment. There are many ways that one can TRIM the FAT and go LEAN on the BUDGET.

Prepare to secure the bag and your financial wealth in 2021 with these free gems from Ali Leonard.

Follow Us On Social Media!