In today’s world, financial freedom and lifestyle choices are more intertwined than ever.

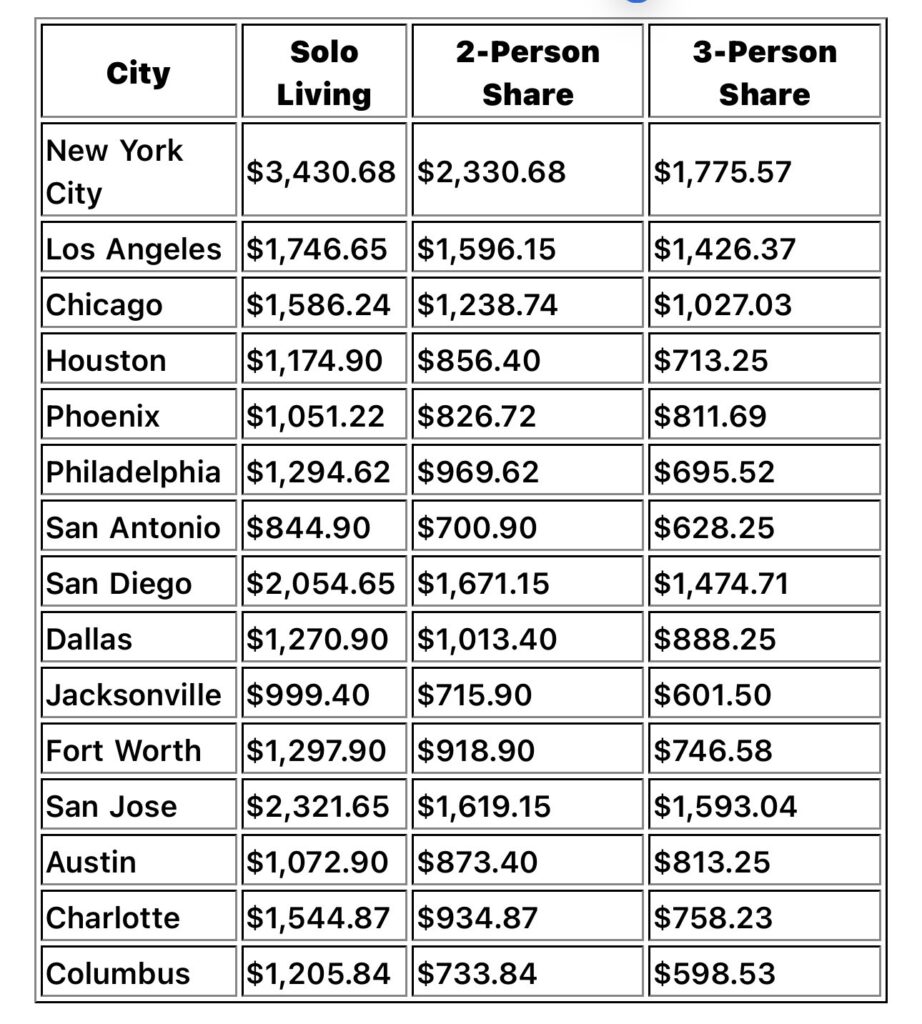

Living alone might feel liberating, but it comes at a steep cost. According to a new analysis by Capital for Life, residents in cities like New York, San Jose, and Los Angeles could be spending hundreds to thousands more per month by living solo compared to sharing a home. From soaring rents to utility bills that climb with each appliance, going it alone can significantly impact your budget, especially during “cuffing season,” when many singles are reassessing their living arrangements.

Capital for Life provides a comprehensive breakdown of monthly expenses across major US cities, highlighting the financial benefits of shared living arrangements.

Monthly Living Costs: Solo vs.Shared

View Full data set here.

Key Takeaways:

- Significant Savings: In cities like New York and San Francisco, living alone can cost over 50% more than sharing a home.

- Utilities and Rent: Shared living arrangements significantly reduce individual expenses related to utilities and rent.

- Financial Flexibility: Opting to share a home can free up funds for savings, investments, or leisure activities.

Tips for Solo Dwellers Looking to Save

- Monitor Utility Use: Track energy and water consumption to spot unnecessary costs.

- Invest in Efficiency: LED lighting, smart thermostats, and energy-efficient appliances reduce monthly bills.

- Consider Part-Time Sharing: Subletting a room or short-term co-living can offset expenses.

- Leverage Streaming & Services Sharing: Split subscriptions with friends or family.

- Budget for Peak Seasons: Winter heating or summer cooling can spike solo household costs; plan accordingly.

“Living alone has undeniable lifestyle appeal: freedom, privacy, and the ability to design your space as you see fit. But the financial reality is striking. Our analysis across 15 major US cities shows that solo living can cost up to 50% more per person than sharing a home. For high-cost cities like New York or San Jose, this difference can exceed $1,500 a month: money that could otherwise go toward savings, travel, or investments.

Utilities play a surprisingly large role in this equation. Heating, cooling, and electricity scale with the number of residents, but solo dwellers shoulder the full burden. Meanwhile, shared households can split costs for internet, streaming services, and appliances, effectively stretching their dollar further.

Cuffing season also highlights a social dimension: singles increasingly live alone, often without the financial cushion of a roommate or partner. This makes understanding costs critical, particularly for younger adults entering the housing market for the first time.

Practical strategies exist for mitigating costs even if living solo. Programmable thermostats, energy-efficient appliances, and careful monitoring of peak utility hours can all reduce bills. But ultimately, sharing a space remains one of the simplest ways to increase financial flexibility without sacrificing lifestyle quality. In today’s economic climate, being strategic about living arrangements isn’t just smart, but also essential,” says Finance and Insurance Expert Carlton Crabbe from Capital for Life.

Source: Capital for Life

Follow Us On Social Media!